Thanks to the advancements in the world of communication, banking has been made more convenient than ever. All major banks in the world have introduced mobile banking, which guarantees a hassle-free experience every time you want to take a peek at your monthly statements. Internet banking, UPI, mobile banking, and others have definitely made life easy for us. But people who are yet to have full confidence in modern-day cybersecurity, are still skeptical about taking the leap.

As you’d expect, hackers have been busy trying to break the cyber vaults of all major banks, and they often resort to sneaky phishing attacks to gain sensitive information from users. Thankfully, if you know where to click and learn to sniff out malicious sites, internet banking on Android won’t feel like rocket science. In this section, we’ll try to teach you all the basics of identifying dubious sites and help you to bank safely on your Android device.

How to find the correct domain of the bank?

As mentioned earlier, hackers and schemers use phishing to gain sensitive information from users. They usually send out emails that look authentic, luring users to follow the attached link; create websites almost identical to original ones, ask users to input their login credentials, and ultimately save the details on a form.

The first logical step would be to not click on any “phishy looking” emails and only use internet banking directly through your bank’s registered, official website.

All leading banks now facilitate internet banking, so, chances are, your internet banking welcome kit would point you towards the legitimate bank website. If not, there’s always the option of a simple Google search. However, before entering sensitive information on the site you just found on Google, make sure you’re in the right place.

Here’s how to:

Step 1: Search for the bank’s name on Google. Open the link from Google’s results — most probably, it would be one of the top results on Google.

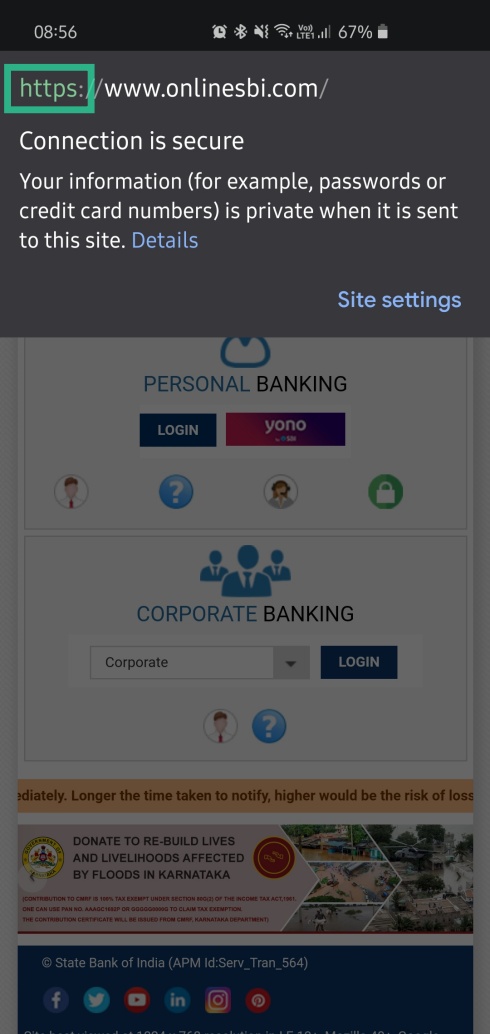

Step 2: Pay close attention to the website address, and see if there’s a padlock sign on the left, meaning, it’s a secure website.

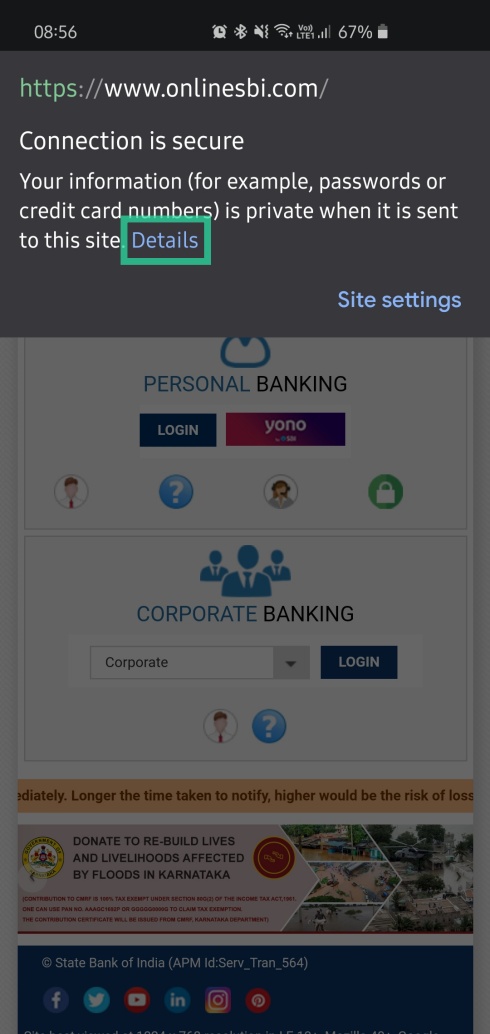

Step 3: If found, click on the padlock icon and verify the following –

- The URL begins with “https”. This means that the site is secure.

- The “https” part is shown in green (Google Chrome), which means that passwords and card numbers you enter on this site stay private.

- The site has SSL certification, which meets the Extended Validation Standard. Tap on Details to see more info.

Found your bank’s website that ticks all the above boxes? Congratulations on finding the authentic site. Make sure to bookmark it for future reference.

Why you should switch to your banking app

Banks are aware of the risks of internet banking, and the anxiety new users tackle when transacting on a website. To remedy that, almost all leading banks now have dedicated apps, which are fully equipped to cater to all your internet banking needs.

You can easily find your bank’s app on the Google Play Store, and we believe it’s the safest bet as well. Fraudulent SMSes or emails can also give you links to your “official” banking app, but they usually redirect to dubious websites that ask you to download .APK files.

So, the safest bet here is to head over to the Google Play store, search for your bank’s app, and download. Google is pretty good at keeping its sites malware-free, so, you’re not likely to find a duplicate app on the Play Store.

Advantages of using a banking app

- One time registration: You’re only required to keep your m-Pin or login password handy. No need to memorize your login ID, the app will do that for you.

- Added security: Some banks even use your device’s fingerprint or iris scanner to add an extra layer of protection.

- Simpler but powerful: Navigating a banking app is generally a lot easier than a full-fledged banking website. Even a couple of years back, apps used to be a lot restrictive. But now, you can even get your loan approved from your banking app.

Should you allow your browser to store passwords?

We have already discussed the pitfalls of traditional internet banking and gave you plenty of reasons why you should switch over to app banking. If you’re still not convinced, you can, of course, continue banking on your browser.

Almost all browsers give you the option of saving your password after you enter it on a website. The same holds true for banking websites as well. It’s a handy feature for sure, especially for people who have a hard time remembering stuff, but there are a couple of things to keep in mind before asking your browser to save the passwords.

- Make sure you’re not using a public computer

- Make sure you’re on a private network

- Make sure only you have access to the PC

So, if you’re on your home network, using your personal computer, you can safely ask your browser to save your passwords for future use.

Is VPN effective?

Virtual Private Network (VPN) is arguably the most powerful web encryption tool known to man. The statement above might feel a little too dramatic, but we assure you that it isn’t. With the help of a powerful VPN, you can hide your internet traffic from everyone — even your Internet Service Provider — change your location, access region-restricted content, and more.

When enabled, your traffic flows through an encrypted VPN tunnel, which conveniently masks your IP address and even your location, if desired. To top it off, VPN services don’t keep a permanent log. So, after a given period of time, no one, not even the VPN service provider remembers your original IP address.

Now that you know a little VPN and its working principle, let’s take a look at whether it can be an effective tool against phishing and snooping.

RELATED:

Paid vs Free

When it comes to VPN services, excellence comes only at a premium. There are a few free services available, but none of them are as reliable or useful as their paid counterparts. To help you out, we have curated a list of five leading VPN services in the world, all of them dependable.

Reasons to have a VPN service for banking

VPN is safe, secure, and, if bought at the right time, doesn’t burn a hole in your pocket. Still, should you take the leap and invest in a VPN service? Check out these two points and decide for yourself.

- If you use a public network: Private connections are always the best bet for internet transactions. However, if your workplace or hotel has public Wi-Fi, having a VPN probably is the next best thing. That way, no snoopers would be able to see your traffic and gain sensitive information.

- If you use mobile banking: Hacking a mobile banking app is not an easy task, but that hasn’t stopped attackers from trying to exploit them. So, even though you’re using a secure mobile app, it’s not a bad idea to have an extra layer of protection through a trusted VPN service.

So, is having a VPN enough?

No, only having a good VPN service isn’t enough. A VPN service is only an added layer of security, but it won’t help much if you transact on untrusted websites. VPN will happily keep the snoopers at bay, but ultimately, it’s the users’ tenacity and attention-to-detail that’d keep them safe from prying eyes and grabby hands.

RELATED: