One of the greatest titles a corporation can earn is the inclusion into the vaulted “$1B club”: medium-sized companies that can generate immense revenue of or in-excess-of said amount. With smartphones becoming more popular than ever, it would logically follow that component sales would also be on the rise. South Korea is a prime producer of such supplies, yet paradoxically a December 7th report discussed by Korean news site ETnews indicates that not a single mid-sized component manufacturer will break the 1 trillion KRW ($916M) mark this year.

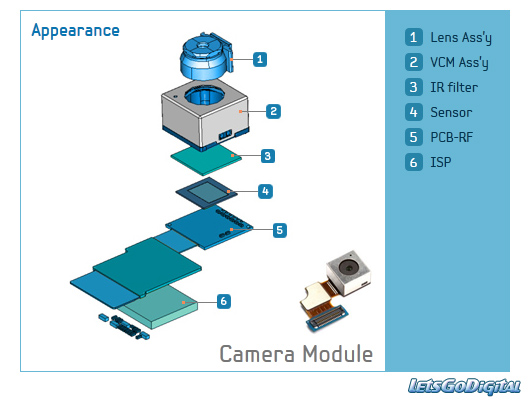

Partron and Intops are two companies which saw supreme success in 2013 and began to earn more than 1 trillion KRW, but which have now missed the mark with the former earning an estimated $549M (600 billion KRW) and the latter $641M (700 billion KRW) in 2017. This is roughly a sales decrease of 40% when compared with their 2013 earnings. Partron in particular was singled out as having made ambitious efforts to improve its earnings via diversification with sales of sensor modules such as fingerprint readers as well as automotive equipment. Unfortunately, its core business of camera modules has been a relative bust.

While companies making dual-camera modules may be seeing a growing uptick in component sales with more and more devices making use of the technology, there is currently no indication any of them will be making the $1B club mark within the next 3 years.

The Causes of Concern

According to ETnews’ report, there are several contributing factors to the component creation crisis:

- As smartphones have become more and more mainstay commodities, OEMs are making even greater demands regarding cost reduction. This problem is intensified by the growing, if not outright stifling competition coming from Chinese component manufacturers as their own technologies and production plants have advanced in recent years. Whereas there was once a “Blue Ocean” of opportunity, it’s now shifted colors to Red.

- South Korea’s decision to purchase the THAAD missile defense system from the United States earlier this year as a method of deterrence and defense against potential North Korean aggression has angered the Chinese government, and as a result there has been a determined resistance to importing components – or cars – of Korean origin. Given that many component manufacturers have diversified into the automobile market, these two issues are interlinked and therefore of major harm to businesses in South Korea.

In contrast to the decline in mid-sized smartphone component supplier’s income, larger conglomerates such as Samsung’s Electro-Mechanics corporation and LG’s Innotec have seen increased sales due to their differentiated products that are of higher value to the premium smartphone segment.

According to Park Won-Jae, a researcher for Mirae-Asset Daewoo,

Polarization of markets for Smartphone parts has become really severe lately. In the midst of this, many of South Korea’s major mid-sized companies are still doing their businesses based on low and medium-priced products rather than high-value premium products. It is not easy for mid-sized companies to join ‘$1 billion club’ as amount of shipments of Smartphones for this year is only 1.9% and Smartphone markets have reached their maturity where sales price continue to fall.

A representative for the smartphone component industry who was cited in the story indicated that in order to solve this growing problem, the smartphone market will need to diversify itself further to compliment the diversification of component products, less the potential for mid-sized manufacturers will dry up entirely.

Analysis

The sales slump being faced by South Korean component companies represents both a more universally-applicable situation (increased competition from abroad) as well as more unique and problematic political problem (North Korea). While some might not see the problem with mid-sized corporations declining while Samsung and LG profit, it boils down to a potential lack of competition on the whole. Should companies like Partron or Intops eventually leave the market, it will create a more monopolistic existence for the larger players, along with the loss of untold numbers of jobs for employees which could have a big effect on the Korean unemployment rate and burden on taxpayers.

This issue also highlights the very clear and present problem that China’s emergence as a major global player in the electronics market represents to the long-established mainstays in both Korea and Japan. In this sense, the current situation being faced by South Korean mid-sized component manufacturers represents a microcosm of the larger change in dynamics sweeping the global market.

Source: ETnews