It’s not always easy to keep track of your finances; especially if you have multiple credit cards. Finance apps have come a long way; from sending you a message when you spend too much, to comparing credit cards for you. A relatively new app in the market is ‘Finder’. The app claims to be a lot and more. Here is what we know about this app so far.

What is the Finder app?

Finder is a finance tracking app created by the Australian company ‘Finder Ventures’. The app claims to be the first of its kind and looks for support from the locals. The app is currently only available in Australia. Since the main features of the app rely on your bank accounts. the app can only be used with Australian banks at the moment.

The Finder app gathers all your financial data under one roof. How safe that is, only time will tell. The app encourages you to add your Savings account, credit cards, home loans, and other expenditure to your account. The app is free to download from the Google Play Store and App Store.

How does Finder work?

The Finder app acts as a repository for your financial data. You can add your credit cards, home loans, etc. to your account. Since the app is linked to your bank account, you can track your spendings right from the app.

The main selling point of the Finder app is how it can consolidate and smartly arrange your financial data to show you your spending patterns. You can also view projections based on current spending and debts.

The Finder app also compares your credit cards with other banks offering better offers. This way you can make a decision knowing all the offers around you.

How to view detailed summaries of your Finances

The Finder app gives a preview of your statement as soon as you launch the app. This depends on what you have linked to the app. So if you have linked your Savings account, credit card, and home loan, you will see all those balances right when you open the app.

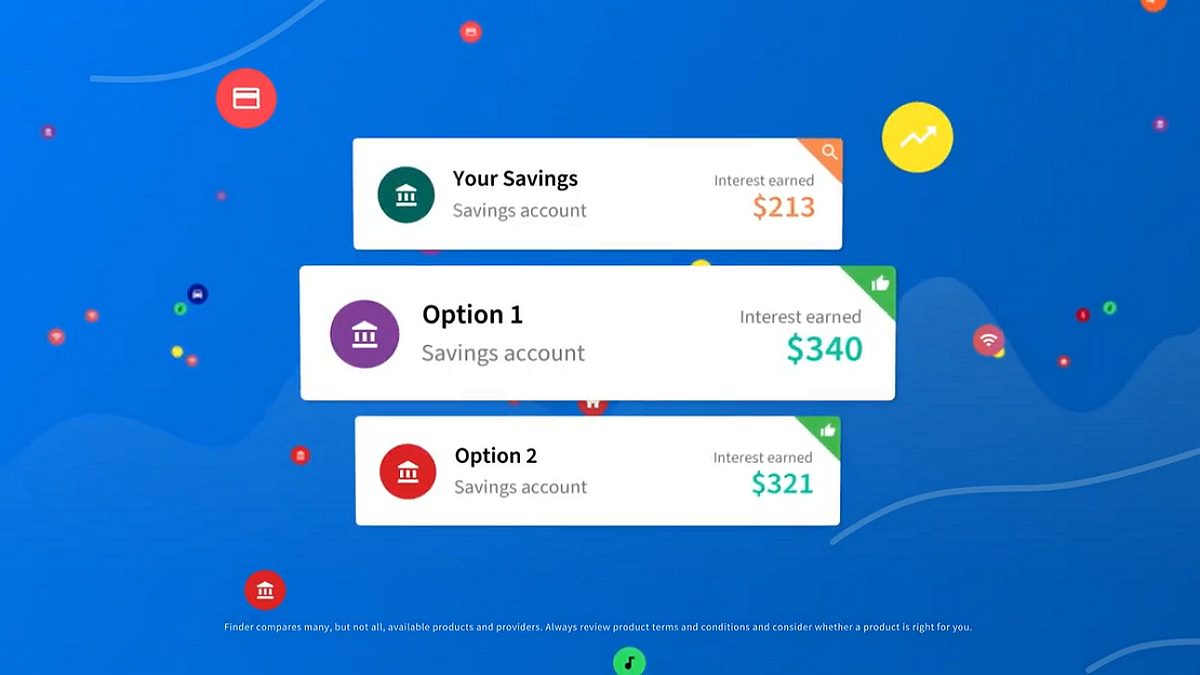

You can also view a break down of each of these, simply by tapping on them. You view your balance, recent transactions, and more within the app. The app will even compare your Savings bank account with the rate of interest offered by other banks. You can then choose where you would like to deposit your cash or consider opening a new account.

In the case of home loans, the app will actually compare your rate with that offered by other banks to help you choose the best option possible.

How to get the Finder app

The Finder app is currently only tied with Australian banks. However, they have mentioned that they are planning on taking the app worldwide. For now, the app is geo-locked to Australia, so you can’t even download it from another location.

The Finder app is available on the Google Play Store and Apple App Store. The app is free to download and use.

Download Finder app: Android | iOS

Which banks does Finder work with?

The Finder app lets you add your bank account, to easily check your balance and spending. The app works with most major Australian banks. But it’s not just banks that Finder works with. You can even add your insurance, home loans, and more.

For a full list of financial institutions that work with Finder, check out the link below.

Link: Finder app available financial institutions

The Finder app is still relatively new but looks to be a game-changer. What do you think about this app? Let us know in the comments below.

Related:

The Finder app downloaded itself to my phone and it won’t uninstall. I had to force stop it. Even forced stop it shows 561KB in data, and with data, cache and app, a total of 823KB, yet I have never used it. I think it is suspect because I read it is only being used in Australia right now. Looking it up, it says it is a banking app, and that it is only connected to Australian bank accounts too. I am in the USA. I have no issues managing my money or wonder what my balance is, so the fact it downloaded itself is super unwanted.