With the second round of stimulus checks coming up, it’s important to ensure the IRS knows the right place to send yours. If you misplace your stimulus check, or it gets lost into the USPS-ether, getting it replaced can be a headache — and nobody needs more of these in these taxing (no pun intended) and stressful times. Down below we’ll run you through exactly how to change address with the IRS so you can rest assured that your stimulus check is on its way to your doorstep.

How to Change Address with the IRS

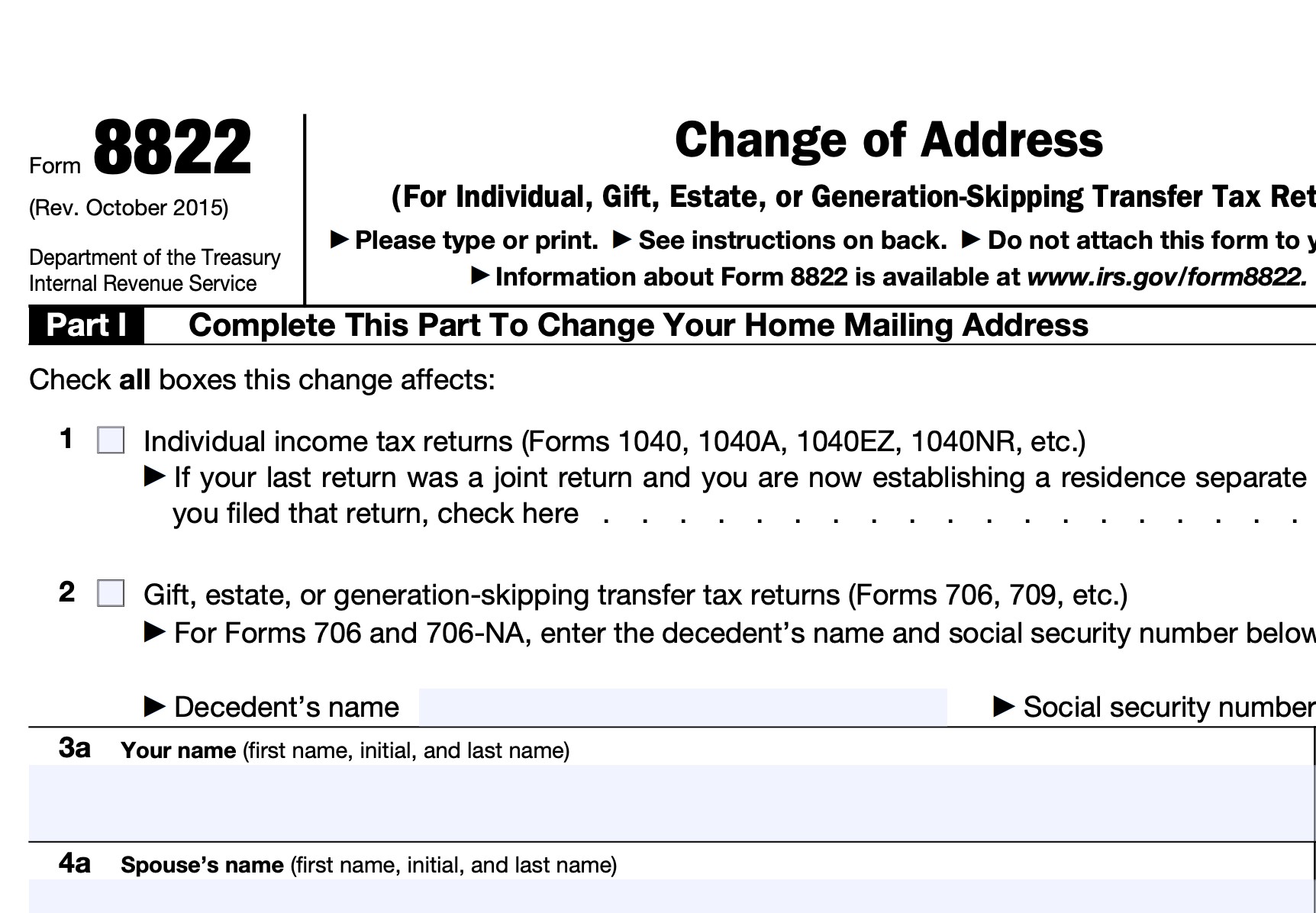

In order to notify the IRS of a change in address, you need to fill out a Form 8822, including your updated information, and then ensure you send it to the correct IRS processing center (more on that below).

1. Head over to IRS.GOV

To find the latest revision of Form 822, head here to the Form 822 About Page or click here to go direct to the current PDF circa January 2021.

2. Fill out the Form 8822

For the vast majority of individuals looking to simply update their address for either Stimulus-check related business or their tax returns, you’re going to want to check the box in Line 01 indicating this your new address in relation to your yearly 1040 tax returns.

In Line 3A, Remember to include any important suffixes to your full name, such as “Jr”, “Sr”, or “III”.

If neither you nor your spouse has changed your name since you last updated your IRS information, you can skip 5a and 5b.

Line 6a is where you will include your previous address, including the street, apartment number, city/town, state and ZIP code.

Line 7 is where you will input your new address, with all of the aforementioned details from street to ZIP code.

It’s recommended to include a telephone number at the beginning of Part III in case the IRS needs to contact you about anything having to do with your address change.

Review your Form 8822, making sure all of the information is correct, and sign and date it.

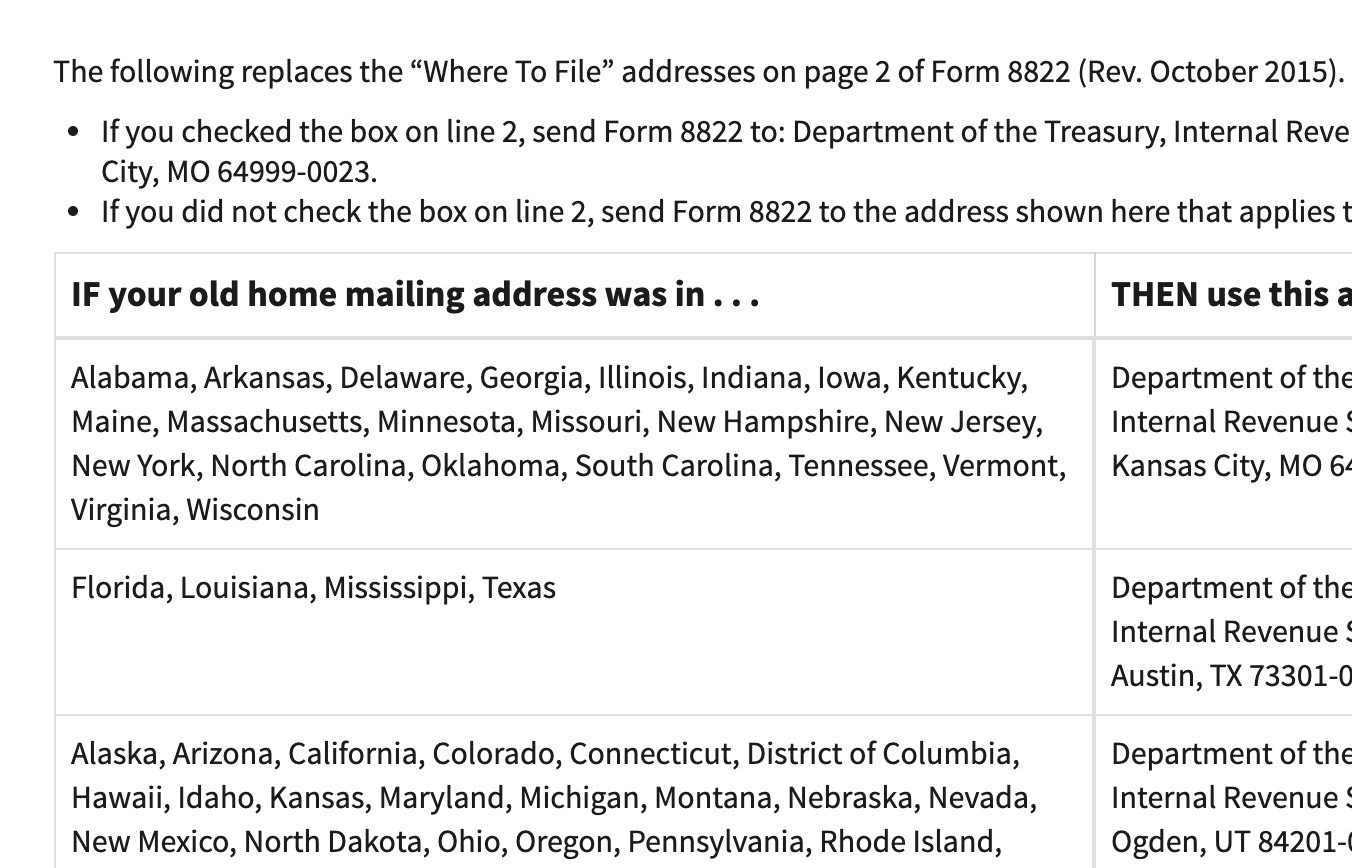

3. Send it to the CORRECT Filing Center

The specific IRS filing location you need to send your Form 8822 varies by state and depends on your previous location. On page 2 you will find some more general information related to the 8822 and, importantly, a breakdown of IRS filing centers by state. You can read another iteration of the same information on the IRS website here.

NOTE: The filing center you need to send it to is related to your OLD address, not your new one. For example, if you moved from Florida to Colorado you would have to send your Form 822 to the IRS Office in Austin, Texas.

And there you go! That’s everything you need to ensure the IRS knows where to send your stimulus checks. If you have any further questions, feel free to ask us down below — we’re always ready to help.