There are some people who can keep track of their expenditures without having to jot them down somewhere. Then there are some that need to make records of all their expenses and incomes to be able to keep track of them. That’s where these Expense Tracking apps come in. With mobile phones becoming an inseparable piece of equipment, what can be a better way to track your expenses than to do it on your phone itself? Why carry notebooks and diaries around when everything can be done on your phone wherever you are?

Android has a plethora of such apps on the Google Play Store (formerly Android Market) that help you track your expenses. We have picked out a few that we think are worth trying out for those who take their expense tracking seriously.

Read on to find out our choices for the best expense tracking apps available for Android.

Free Expense Tracking Android Apps ¬

[hr /]

Money Lover – Expense Manager

Money Lover lets you add different transactions based on four categories, namely Income, Expense, Receivable, and Payable. Each transaction can be added with details such as the amount, custom notes, date, and so an option to add a repeat schedule so that the transaction is added again according to what schedule you choose, such as start week, end quarter, etc. The Cashbook shows you all your transactions and expenses in a list. Campaigns can be added for taking care of your budgets. A separate bill management section helps you keep track of all your bills like electricity, telephone and more. Oh, and you can also add different accounts for different persons, with the ability to transfer data from one account to another.

[button link=”https://play.google.com/store/apps/details?id=com.bookmark.money” icon=”arrow” style=””]Download Money Lover[/button]

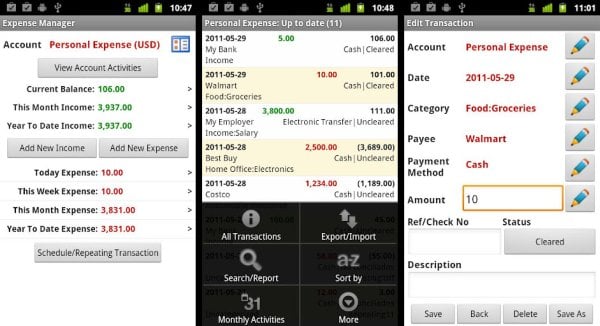

Expense Manager

Expense Manager starts up with showing you your total balance, income, and the expenses for the day, week and month. Here, you can add new incomes or expenses, along with extra details such as the date, amount, payer, mode of payment (cash, check, credit or debit card, electronic transfer), ref/check no. in case you pay with check, and a brief description of the transaction. There is also an Auto Fill feature that lets you add templates for quick filling of details when adding transactions. The daily, weekly, monthly and yearly expense and income can be viewed in chart form. Alerts for payments can also be added to make sure you never miss a payment.

[button link=”https://play.google.com/store/apps/details?id=com.expensemanager” icon=”arrow” style=””]Download Expense Manager[/button] [button link=”https://play.google.com/store/apps/details?id=com.expensemanager.pro” icon=”arrow” style=””]Expense Manager Pro $4.99[/button]

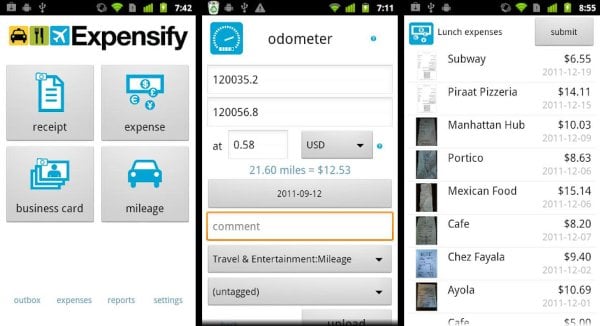

Expensify – Expense Reports

Expensify is unique thanks to its SmartScan technology, which lets you take photos of business cards and receipts to auto detect information instead of having to enter it manually. Scanning business cards gives you the option to invite persons to Expensify using their email address. Expenses can be added with different details like amount, currency, category, and uploaded to your online Expensify account. The Mileage section lets you add details of miles traveled along with cost per mile and total cost for entire trip, to take care of your travelling expenses.

[button link=”https://play.google.com/store/apps/details?id=org.me.mobiexpensifyg” icon=”arrow” style=””]Download Expensify – Expense Reports[/button]

MoneyWise

MoneyWise is pretty simple to use. You can create multiple accounts, then add new transactions for both expenses and incomes for each account, adding details like amount, date, description, etc. You can add a monthly, yearly or endless budget, then get a list of all expenses in that budget. The Balance screen shows you your total balance, along with the end of month balance, for each account. Graph views of both income and expense are available for viewing. Also, transfers can be made between different accounts as and when required.

[button link=”https://play.google.com/store/apps/details?id=com.handynorth.moneywise_free” icon=”arrow” style=””]Download MoneyWise[/button] [button link=”https://play.google.com/store/apps/details?id=com.handynorth.moneywise” icon=”arrow” style=””]MoneyWise Pro $6.99[/button]

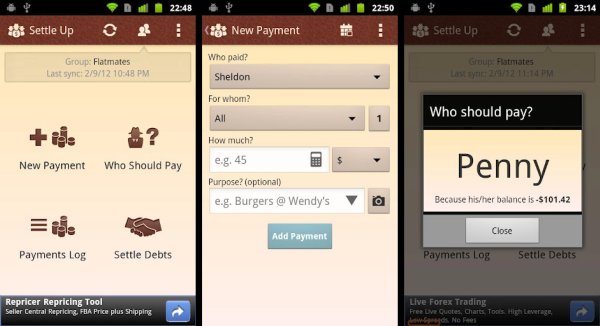

Settle Up

Settle Up has one main aim: help you settle up payments in a group by letting you know who needs to pay what amount to settle a debt. New payments can be added with details of who paid what amount and for which members of the group they paid it, so the remaining balance of each member of the group can be calculated. The Payments Log shows you the history of all the payments made in the group, while the Settle Debts section lets you clear existing debts after they have been settled. Integrated PayPal support can be used to make payments using the app itself.

[button link=”https://play.google.com/store/apps/details?id=cz.destil.settleup” icon=”arrow” style=””]Download Settle Up[/button]

Best Paid Expense Tracking Android App ¬

[hr /]

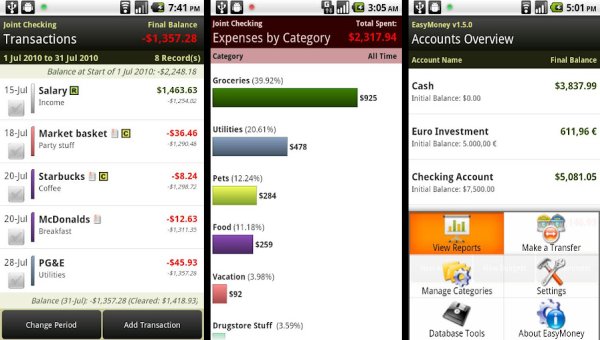

EasyMoney ($10)

EasyMoney lets you add different accounts, with each account having Cash, Credit Card and Bank Account sections. Transactions can be added to any of the three sections with details like amount, category, type of transaction, notes, receipt photos, etc. Custom expense categories can also be added. Monthly budgets can be set to help you make sure you never go above your monthly allowance. You can make transfers between bank accounts, credit cards and cash accounts. The View Reports option lets you view reports for income, expense, cash flow, and also categorically divided reports. Bill reminders can be set to make sure you never miss a bill payments. And last but not the least, you can export all the data in the app as a database, and also import databases.

[button link=”https://play.google.com/store/apps/details?id=com.handyapps.easymoney10″ icon=”arrow” style=””]EasyMoney $10[/button][button link=”https://play.google.com/store/apps/details?id=com.handyapps.easymoney” icon=”arrow” style=””]EasyMoney 30 Day Trial[/button]

[hr /]

Bonus App Recommendation ¬

My Cars

My Cars focuses on helping you take care of your car related expenses, like fuel spent, fuel price, refueling details, and more. All your cars can be added with details like make and model, price, fuel type, initial mileage, tire size and pressure, etc. Refuel transactions with details such as trip distance, refuel cost, road type, driving style, etc, can be entered into the app to keep a tab on them. The app calculates and shows you the best and worst fuel efficiency data based on your entries. There is also a fully detailed chart option that shows you charts and graphs for a lot of results and data. My Cars is one of the best apps for taking care of your car expenses.

[button link=”https://play.google.com/store/apps/details?id=com.aguirre.android.mycar.activity” icon=”arrow” style=””]Download My Cars[/button]

[hr with=top /]

And here we come to the end of the round-up. The above are some of the best expense tracking apps we could find and think you should give them a go. Of course, there are quite a few other apps available on Android. So if there’s an app that you like and think should be up on that list, do let us know in the comments below.

I have used expensify earlier and it it the best one..

I have used expensify earlier and it it the best one..

I used mint it’s pretty good as you don’t have to enter all your expenses but it’s so not customizable. Impossible to use it just by itself, that’s why I got “droid money” that is a perfect complement of mint I highly recommend it. Completely customizable and really fast to use!

I used mint it’s pretty good as you don’t have to enter all your expenses but it’s so not customizable. Impossible to use it just by itself, that’s why I got “droid money” that is a perfect complement of mint I highly recommend it. Completely customizable and really fast to use!

Toshl is missing here, I love it very much

Toshl is missing here, I love it very much

Try my app, ExpenseClam. Optimised for both phones and tablets.

Try my app, ExpenseClam. Optimised for both phones and tablets.

hope they will raise the money, sounds promessing: http://www.indiegogo.com/projects/android-private-accountant/x/946106

hope they will raise the money, sounds promessing: http://www.indiegogo.com/projects/android-private-accountant/x/946106

try Money Moni

https://play.google.com/store/apps/details?id=com.ebeyonds.expensetracker

try Money Moni

https://play.google.com/store/apps/details?id=com.ebeyonds.expensetracker

Expense tracking helps manage the ongoing expenses with a specific streamlined fashion provided the technology involved in the same must meets the requirement in perfect sense. Apps desired for the expense tracking and management and reporting as well must be in a user friendly interface to make the things done up in well defined manner.

One such expense reporting app which we have been using in our office is from Replicon – http://www.replicon.com/olp/expense-reports.aspx which is cloud based with multiple functionalities that helps expense reporting go in a successful manner. This particular software is hassle free in use with magnificent usability implemented in it for a better management and reporting. Works smoothly in android as well as iOS devices, this particular app has been booming up in the market in terms of whole HR management systems.

You can also consider the same including in this tremendous list of expense tracking android apps.

Expense tracking helps manage the ongoing expenses with a specific streamlined fashion provided the technology involved in the same must meets the requirement in perfect sense. Apps desired for the expense tracking and management and reporting as well must be in a user friendly interface to make the things done up in well defined manner.

One such expense reporting app which we have been using in our office is from Replicon – http://www.replicon.com/olp/expense-reports.aspx which is cloud based with multiple functionalities that helps expense reporting go in a successful manner. This particular software is hassle free in use with magnificent usability implemented in it for a better management and reporting. Works smoothly in android as well as iOS devices, this particular app has been booming up in the market in terms of whole HR management systems.

You can also consider the same including in this tremendous list of expense tracking android apps.

Hello, I found your article very interesting. Thanks for sharing. You can also add Moon Invoice to your list it’s also the best app to use for expense tracking.